Pre-Approval Power: Why Getting Pre-Approved is Your First Step to Buying an Albuquerque Home

When you decide it’s time to start buying a home in Albuquerque, the first step isn't usually house hunting—it’s paperwork. Specifically, it's getting a mortgage pre-approval. In the competitive landscape of Albuquerque real estate, a pre-approval letter isn't just a suggestion; it’s a non-negotiable asset that determines how quickly and successfully you can secure your dream home.

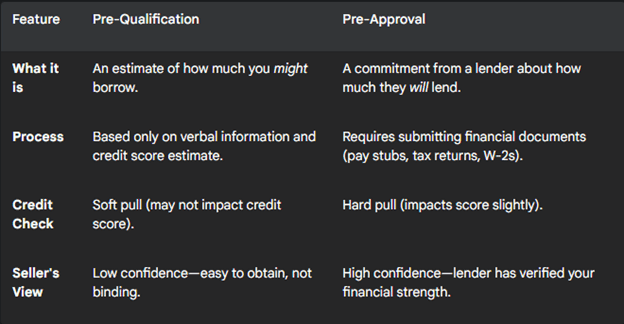

The Difference Between Pre-Qualification and Pre-Approval

These terms often get confused, but they are dramatically different when you are making an offer:

In the Albuquerque market, especially when inventory is tight, a pre-approved mortgage gives you a significant edge over a pre-qualified buyer.

Why Pre-Approval is Your Power Play in ABQ

1. It Confirms Your Budget

Albuquerque has diverse neighborhoods and varying price points. Pre-approval defines your true budget, preventing the disappointment of falling in love with a home outside your financial reach. Once you know your approved loan amount, we can efficiently narrow down our search to homes that fit your finances and your needs.

2. It Gives Your Offer Immediate Weight

Sellers want certainty. They don't want to accept an offer only to have the financing fall apart weeks later. When we submit an offer accompanied by a robust pre-approval letter, it tells the seller: "This buyer is serious, vetted, and ready to close." In a multiple-offer situation, a pre-approved buyer is often chosen over one who is merely pre-qualified, even if the offers are similar.

3. Faster Closings and Less Stress

Since the lender has already vetted your financial profile, the mortgage process ABQ-style moves much faster once the house is under contract. You’ve tackled the hardest part of the financial legwork upfront, minimizing last-minute document scrambles and reducing the overall closing timeline.

Your Pre-Approval Checklist

Ready to get started? Here are the common documents your lender will require:

- Income Verification: Two most recent pay stubs, W-2s from the last two years.

- Asset Documentation: Bank statements, investment account statements.

- Tax Returns: Tax returns from the last two years (especially if you are self-employed).

- Identification: Driver's license and Social Security card.

Getting pre-approved is the most crucial preparation step you can take. It essentially transforms you from a window-shopper into a serious, competitive buyer ready to act quickly when the perfect home hits the market.

Let's discuss getting you connected with a trusted local lender to begin the mortgage process ABQ today!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "